Idaho Tax Assessed Value . Also the idaho state tax commission sets property tax values for operating property, which consists mainly of public. To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the idaho and u.s. Idaho law requires that all taxable property be assessed at market value. (1) all real, personal and operating property subject to property taxation. Assessment — market value for assessment purposes. In idaho, county assessor’s offices assess value on personal property in their county. An appraiser from the county assessor’s office.

from www.dochub.com

(1) all real, personal and operating property subject to property taxation. Compare your rate to the idaho and u.s. In idaho, county assessor’s offices assess value on personal property in their county. Idaho law requires that all taxable property be assessed at market value. Also the idaho state tax commission sets property tax values for operating property, which consists mainly of public. An appraiser from the county assessor’s office. To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Assessment — market value for assessment purposes.

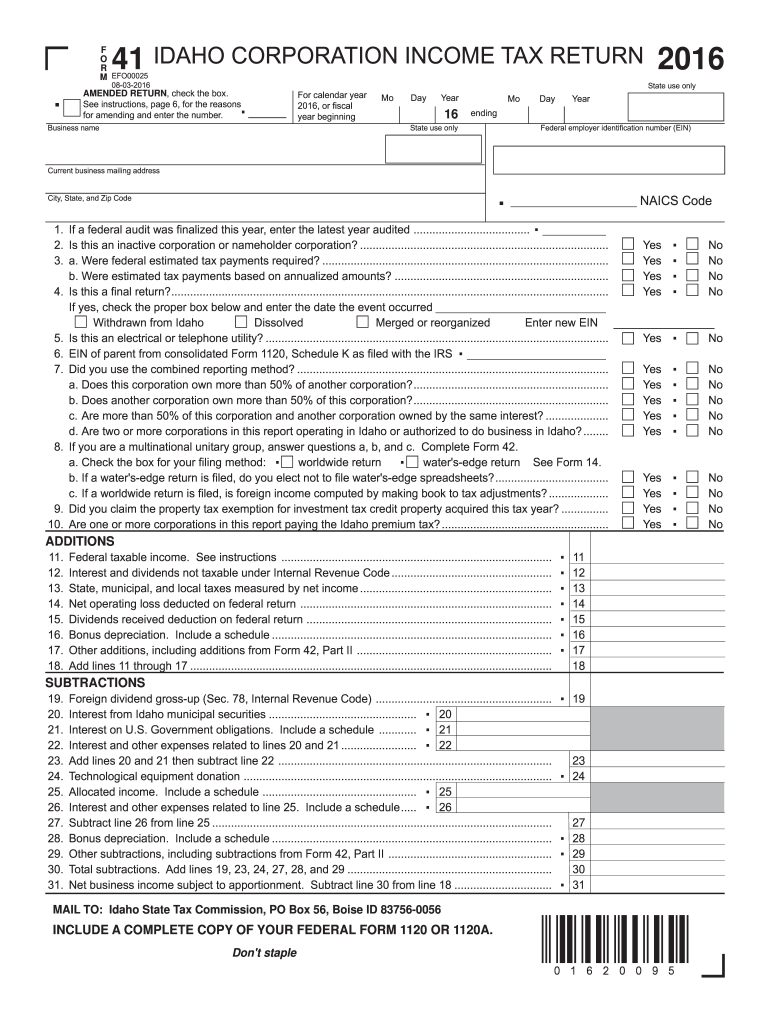

Idaho tax Fill out & sign online DocHub

Idaho Tax Assessed Value Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Also the idaho state tax commission sets property tax values for operating property, which consists mainly of public. (1) all real, personal and operating property subject to property taxation. Idaho law requires that all taxable property be assessed at market value. In idaho, county assessor’s offices assess value on personal property in their county. Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. Assessment — market value for assessment purposes. Compare your rate to the idaho and u.s. An appraiser from the county assessor’s office.

From www.formsbank.com

Fillable Form 850U Idaho SelfAssessed Use Tax Worksheet And Return Idaho Tax Assessed Value Compare your rate to the idaho and u.s. Also the idaho state tax commission sets property tax values for operating property, which consists mainly of public. Idaho law requires that all taxable property be assessed at market value. Assessment — market value for assessment purposes. Calculate how much you'll pay in property taxes on your home, given your location and. Idaho Tax Assessed Value.

From www.slideserve.com

PPT 2008 Annual Report Submitted by Tonya Galbraith, Town Manager Jan Idaho Tax Assessed Value To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. Compare your rate to the idaho and u.s. Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. In idaho, county assessor’s offices assess value on personal property in their. Idaho Tax Assessed Value.

From stateimpact.npr.org

Idaho Ranks 21st in the Annual State Business Tax Climate Index Idaho Tax Assessed Value Compare your rate to the idaho and u.s. To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. An appraiser from the county assessor’s office. In idaho, county assessor’s offices. Idaho Tax Assessed Value.

From tax.idaho.gov

2023 Economic Estimates Commission Day 1 Idaho State Tax Commission Idaho Tax Assessed Value Assessment — market value for assessment purposes. An appraiser from the county assessor’s office. In idaho, county assessor’s offices assess value on personal property in their county. Also the idaho state tax commission sets property tax values for operating property, which consists mainly of public. Compare your rate to the idaho and u.s. Idaho law requires that all taxable property. Idaho Tax Assessed Value.

From medium.com

Idaho Taxes Analysis. Understand taxes? Like local option… by Cam Idaho Tax Assessed Value Compare your rate to the idaho and u.s. Assessment — market value for assessment purposes. An appraiser from the county assessor’s office. Idaho law requires that all taxable property be assessed at market value. To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. In idaho, county assessor’s. Idaho Tax Assessed Value.

From www.tax.ny.gov

Overview of the assessment roll Idaho Tax Assessed Value Also the idaho state tax commission sets property tax values for operating property, which consists mainly of public. (1) all real, personal and operating property subject to property taxation. In idaho, county assessor’s offices assess value on personal property in their county. An appraiser from the county assessor’s office. Compare your rate to the idaho and u.s. Idaho law requires. Idaho Tax Assessed Value.

From www.youtube.com

WHAT ARE TAXES IN IDAHO? YouTube Idaho Tax Assessed Value (1) all real, personal and operating property subject to property taxation. Also the idaho state tax commission sets property tax values for operating property, which consists mainly of public. To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. Compare your rate to the idaho and u.s. Assessment. Idaho Tax Assessed Value.

From www.tax-rebate.net

Idaho Tax Rebate 2023 Eligibility, Application, And Deadline Tax Idaho Tax Assessed Value Compare your rate to the idaho and u.s. (1) all real, personal and operating property subject to property taxation. Idaho law requires that all taxable property be assessed at market value. In idaho, county assessor’s offices assess value on personal property in their county. An appraiser from the county assessor’s office. To understand the true relationship between your assessed value. Idaho Tax Assessed Value.

From medium.com

Idaho Taxes Analysis. Understand taxes? Like local option… by Cam Idaho Tax Assessed Value To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. In idaho, county assessor’s offices assess value on personal property in their county. Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Also the idaho state tax commission sets. Idaho Tax Assessed Value.

From kezj.com

How Does Idaho Taxes Compare to Other States? Idaho Tax Assessed Value To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. Idaho law requires that all taxable property be assessed at market value. An appraiser from the county assessor’s office. Compare your rate to the idaho and u.s. Assessment — market value for assessment purposes. In idaho, county assessor’s. Idaho Tax Assessed Value.

From klewtv.com

tax rebate checks for Idaho residents Idaho Tax Assessed Value Also the idaho state tax commission sets property tax values for operating property, which consists mainly of public. Compare your rate to the idaho and u.s. (1) all real, personal and operating property subject to property taxation. Assessment — market value for assessment purposes. Calculate how much you'll pay in property taxes on your home, given your location and assessed. Idaho Tax Assessed Value.

From boisedev.com

Explain this to me Inside Idaho's complicated property tax system Idaho Tax Assessed Value An appraiser from the county assessor’s office. In idaho, county assessor’s offices assess value on personal property in their county. Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Also the idaho state tax commission sets property tax values for operating property, which consists mainly of public. Compare your rate to. Idaho Tax Assessed Value.

From www.youtube.com

L8ln24UqY6J3yFHVvOufWF6YuZYTeEGNQCvmxnat4KC Idaho Tax Assessed Value An appraiser from the county assessor’s office. To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. Also the idaho state tax commission sets property tax values for operating property, which consists mainly of public. Calculate how much you'll pay in property taxes on your home, given your. Idaho Tax Assessed Value.

From www.templateroller.com

Form 1350U (EFO00130) Fill Out, Sign Online and Download Fillable Idaho Tax Assessed Value Assessment — market value for assessment purposes. An appraiser from the county assessor’s office. (1) all real, personal and operating property subject to property taxation. Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. To understand the true relationship between your assessed value and property tax charge, you first must understand. Idaho Tax Assessed Value.

From medium.com

Idaho Taxes Analysis. Understand taxes? Like local option… by Cam Idaho Tax Assessed Value Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the idaho and u.s. An appraiser from the county assessor’s office. Also the idaho state tax commission sets property tax values for operating property, which consists mainly of public. To understand the true relationship between your assessed value. Idaho Tax Assessed Value.

From medium.com

Idaho Taxes Analysis. Understand taxes? Like local option… by Cam Idaho Tax Assessed Value Assessment — market value for assessment purposes. (1) all real, personal and operating property subject to property taxation. To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. In idaho, county assessor’s offices assess value on personal property in their county. Compare your rate to the idaho and. Idaho Tax Assessed Value.

From www.youtube.com

How to File Your TAXES FOR FREE in Idaho (Efile Taxes) YouTube Idaho Tax Assessed Value An appraiser from the county assessor’s office. Compare your rate to the idaho and u.s. Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Idaho law requires that all taxable property be assessed at market value. Assessment — market value for assessment purposes. In idaho, county assessor’s offices assess value on. Idaho Tax Assessed Value.

From itep.org

How the House Tax Proposal Would Affect Idaho Residents’ Federal Taxes Idaho Tax Assessed Value An appraiser from the county assessor’s office. Idaho law requires that all taxable property be assessed at market value. (1) all real, personal and operating property subject to property taxation. To understand the true relationship between your assessed value and property tax charge, you first must understand the basics of idaho’s property. Calculate how much you'll pay in property taxes. Idaho Tax Assessed Value.